Introduction to GST in India

In 2000, Indian Prime Minister Atal Bihari Vajpayee formed a committee to draft the Goods and Services Tax (GST) Bill, aiming to create a unified and simplified tax structure. The United Progressive Alliance (UPA) government introduced the Bill in Lok Sabha in 2012. Following multiple changes, the National Democratic Alliance (NDA) government reintroduced the Bill in 2014. Both houses of Parliament passed the Bill in 2017, marking the implementation of GST, which revolutionized the Indian tax system.

Key Features of GST

- Single Indirect Tax:

- GST replaced multiple indirect taxes at the central and state levels, including Central Value Added Tax, Service Tax, VAT, and others, consolidating them into a single tax. This simplification has made compliance easier for businesses and has lowered the cost of goods and services for consumers.

- Input Tax Credit System:

- The GST system allows businesses to claim an input tax credit on the taxes already paid on purchases, offsetting the tax liability on their output. This system reduces the cascading effect of taxes (tax-on-tax) and helps in lowering tax evasion.

- GST Composition Scheme:

- Small and medium enterprises (SMEs) with an annual turnover of up to Rs. 1 crore (or Rs. 75 lakh in specified states) can opt for the composition scheme. Under this scheme, businesses pay a fixed GST rate of 1% on their turnover but cannot avail the input tax credit.

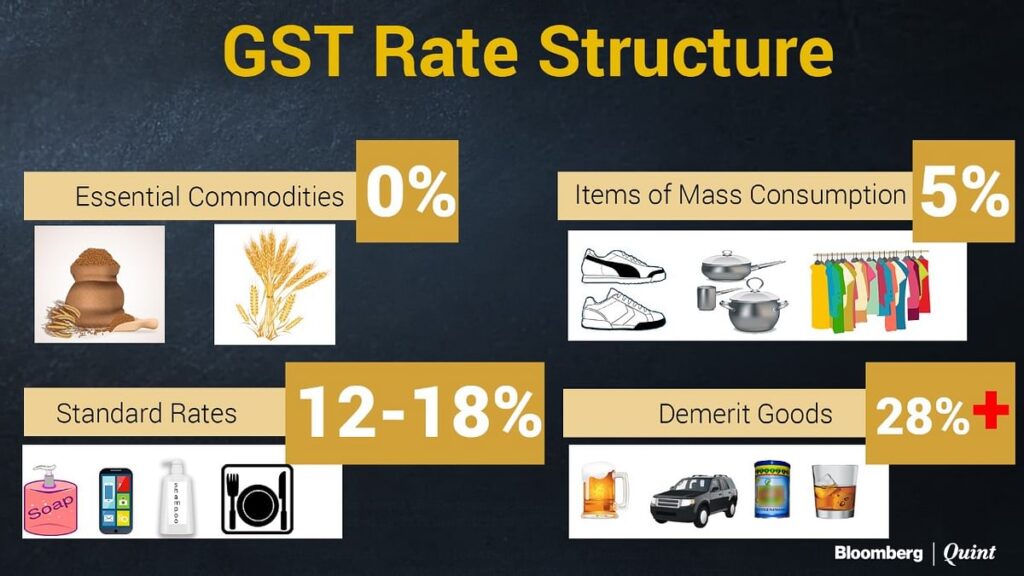

- Four-Tier Tax Structure:

- GST operates on a four-tier tax rate structure of 5%, 12%, 18%, and 28%. Essential commodities, such as food items, are exempt from GST, promoting transparency and making many goods and services cheaper.

Importance of GST

- Unified Market:

- GST has transformed India into a common national market by eliminating state-level entry taxes and barriers, boosting inter-state trade, reducing logistics inefficiencies, and enhancing business efficiency.

- Enhanced Competitiveness:

- The streamlined tax system creates a level playing field for businesses across regions, promoting healthy competition, boosting manufacturing, and encouraging businesses to optimize their supply chains.

- Higher Compliance:

- The technology-driven GST system encourages higher compliance rates among taxpayers through online filing and transparent processes, making it harder for businesses to evade taxes.

- Improved Input Tax Credit:

- By allowing businesses to claim an input tax credit on taxes paid at earlier stages, GST reduces the tax burden on businesses and prevents tax cascading.

- Boost to Economic Growth:

- GST promotes efficiency, reduces tax barriers, and enhances trade, contributing to economic growth by attracting investment, creating jobs, and stimulating overall economic activity.

- Formalization of Economy:

- GST incentivizes businesses to operate within the formal economy due to transparency and compliance requirements, widening the tax base and curbing black money.

- Government Revenue:

- GST provides a stable and predictable revenue source for both central and state governments, facilitating effective revenue planning and expenditure management.

- Harmonization of Tax Rates:

- GST aims to standardize tax rates across goods and services, reducing complexity and confusion for taxpayers and ensuring a more consistent tax structure.

Types of GST

- Central GST (CGST): Levied by the central government on intra-state supplies of goods and services.

- State GST (SGST): Levied by the state government on intra-state supplies.

- Integrated GST (IGST): Levied by the central government on inter-state supplies and imports.

- Union Territory GST (UTGST): Levied in Union Territories.

Benefits of GST

- Simple Compliance:

- The GST regime is built on a robust IT system, making compliance simple and transparent with online access to taxpayer services like registration, payment, and returns.

- Uniformity of Tax Rates and Structures:

- GST ensures consistent tax rates and structures, making it tax-neutral to conduct business across the country, simplifying operations for businesses.

- Better Leakage Controls:

- The IT infrastructure of GST improves tax compliance and ensures timely tax payments through the easy transfer of input tax credits along the value chain.

Conclusion

Implementing GST in India has significantly restructured the indirect taxation system. By consolidating multiple state and central taxes into a single tax, GST has eliminated double taxation and created a common national market. From the consumers’ perspective, GST has reduced the total tax burden on goods and services. The effective implementation of GST also demonstrates India’s capacity to support enterprises across various industries, attracting foreign investment and fostering economic growth.